The eighth edition of BeanScene’s roasters directory celebrates more than 850 Australian and New Zealand coffee roasters who remain committed to growing the industry despite another unpredictable year.

For the past year and a half, Australian and New Zealand roasters have battled the coronavirus pandemic in their own way. They have been challenged by supply and demand, market volatility, rising coffee prices, and in some regions, reduced wholesale volumes and increased domestic sales.

“As expected, we did notice an overall decline in the volume of roaster participants this year, with our tally reaching 851 roasters. Of course, while we don’t claim to know every roaster in the country, we do know that for some smaller-sized roasters, a final lockdown may have proven one too many,” says BeanScene Editor Sarah Baker.

This year, 123 businesses responded to our optional and anonymous survey to help provide a more quantitative look at their buying habits, volume, operation, and impact from the coronavirus pandemic. Yes, not everyone loves a two-minute survey, but what it does help paint is a realistic view of the challenges and shared thoughts of our roasting industry.

When it comes to volume of roasted coffee per week, 30 per cent of respondents said they roast between 100 to 300 kilograms per week, 21 per cent said less than 100 kilograms, 16 per cent said between 300 to 500 kilograms, 15 per cent said between 500 to 1000 kilograms, 8 per cent between 1000 to 3000 per cent, 5 per cent between 300 to 5000 kilograms, and 1 per cent roasted between 500 to 10,000 kilograms per week. Less than 0.8 per cent roasted more than 10,000 kilograms per week.

Forty-four per cent said that this volume was “about the same” over the past 12 months. Around 38 per cent said it had increased and 17 per cent said the volume had decreased.

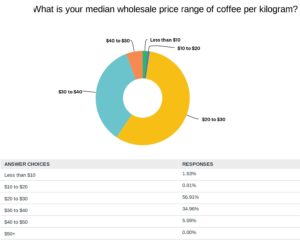

The highest response for the median wholesale price of coffee per kilogram was $20 to $30 at 51 per cent, the same response from respondents over the past two years. The second most common price was the $30 to $40 bracket at 34 per cent.

While these stats suggest a slight bounce back from 2020, there is still a degree of uncertainty heading into 2022. With a roadmap now outlined for two major Australian states, here’s hoping that uncertainty will soon turn into optimism and motivation to build a bigger and better year ahead.

*The 2021 Roasters Directory is compiled of opt-in participants and verified venues. If you have missed out or need to update your details for next year’s directory, please email sarah.baker@primecreative.com.au.